Pay transparency laws have gained momentum globally, aiming to promote fairness and prevent pay discrimination in the workplace.

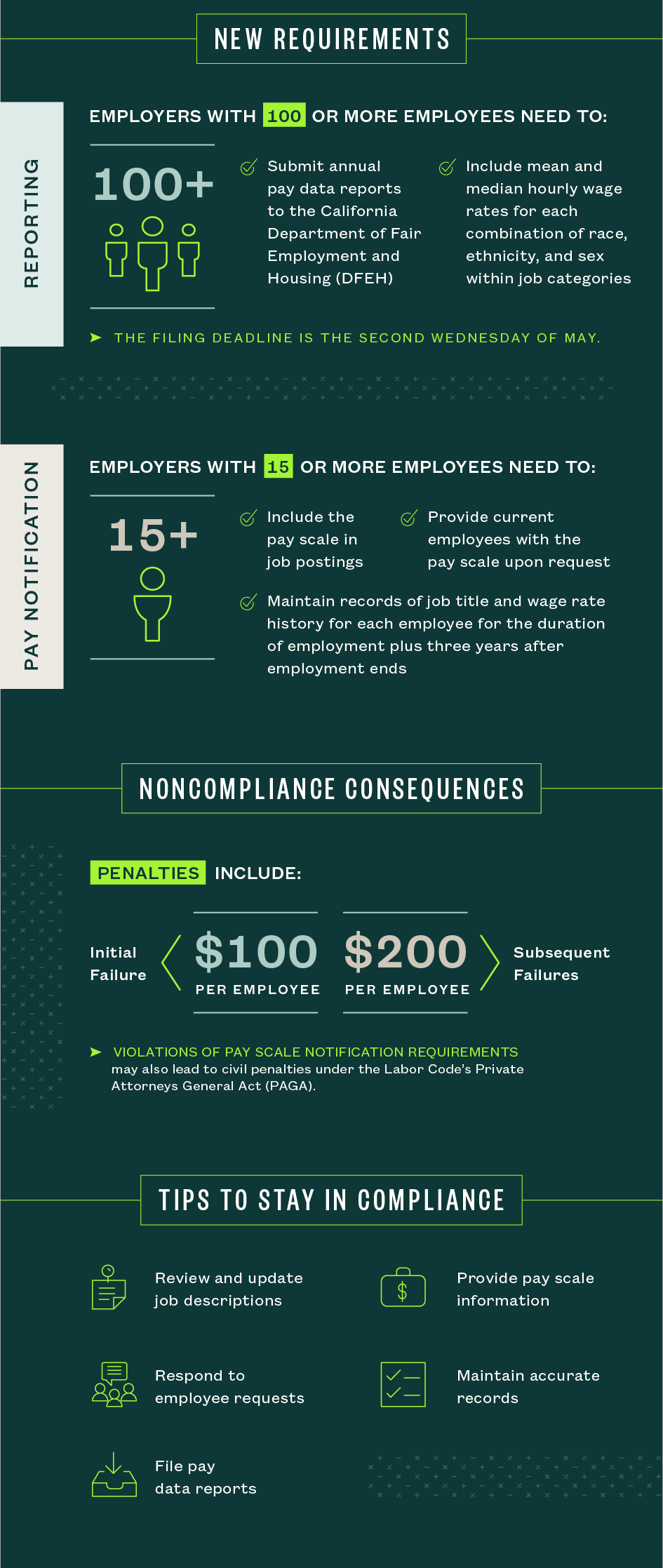

The California Pay Transparency Act, Senate Bill (SB) 1162, imposes requirements on organizations with at least 15 employees, such as including wage scales on job postings.

Here’s what you need to know to stay compliant. See detailed information on SB 1162 in Understanding SB 1162: California's Pay Transparency Act.

Transparency, Compliance, and SB 1162

We’re Here to Help

For guidance on SB 1162 requirements and maintaining compliance, contact your Moss Adams professional.